JANUARY 2024 | PROPERTY MARKET REVIEW

Welcome to our latest monthly review, which looks back on January, its key developments and some of the most noteworthy reports concerning the residential property sector.

The latest house price indices show that average values ended the year mostly unchanged; perhaps a little down according to some indices, but certainly not by anything like as much as forecasts had suggested at the start of 2023. It is also worth noting that some sources have reported continuing growth in more northerly regions, and two of them have indicated that the UK average has returned to month-on-month growth.

In the rental market, the north-south divide that was so apparent in 2023 has begun to close, with fewer obvious regional differences in terms of annual growth. In all regions, that growth continues to rise far ahead of the rate of inflation, which is now running at 4.0%. On the question of yields, geographical patterns are more evident, with lower-priced markets such as Wales and the North West delivering the best returns for investors.

Darren Bennett

Managing Director

—————————

HOUSE PRICE INDICES

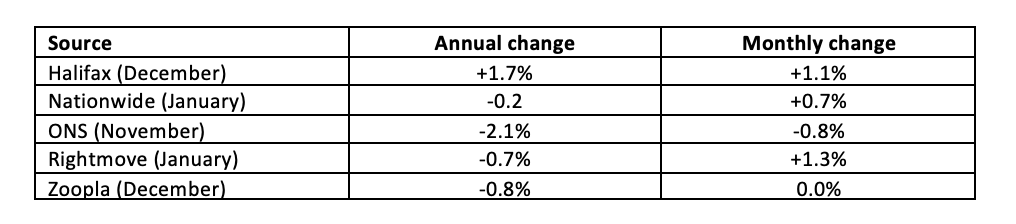

The following organisations produced house price indices in recent weeks. (Percentages refer to capital growth rates.)

In its January House Price Index, Nationwide reported a 0.7% month-on-month gain in average prices, which it described as “the strongest outturn since January 2023.” Home.co.uk, in its January Asking Price Index reported no monthly change. However, in its December index, published in early January, Halifax reported that UK house prices had risen for the third consecutive month, up by +1.1% monthly, and by +1.7% year-on-year.

Rightmove’s January Price Index reported a +1.3% monthly gain. It pointed out that this was “the biggest December to January increase in prices since 2020,” and was more than double the 20-year average. It added that market activity has been “markedly stronger than a year ago… The number of sales agreed is +20% higher than during the first week of last year, indicating a strong return of buyer confidence.” Zoopla’s January Index also reported “a strong seasonal rebound in sales activity in the first weeks of January, on the back of pent-up demand and sub-5% mortgage rates.”

Published on 20 December, the latest ONS House Price Index relates to November. Its monthly and annual figures show poorer growth than the lenders’ data, but they include an element of lag.

NATIONAL AND REGIONAL PATTERNS

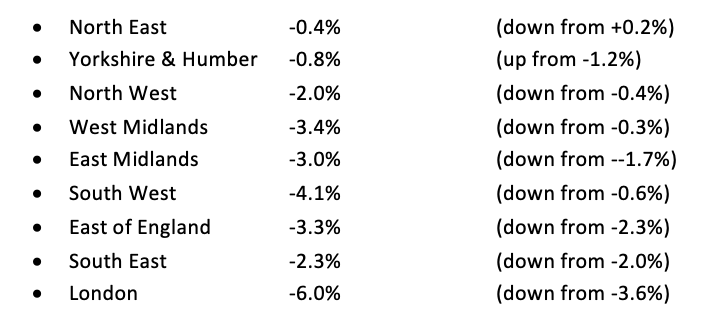

According to ONS data, covering the 12 months to January 2024, the state-level pattern of annual price growth was as follows:

ONS lists growth rates in the English regions as follows:

Note that these ONS figures lag behind other indices by at least a month and they will therefore be slower to register any upturn in values.

HOUSE PRICE FORECAST

In its December index, Halifax stuck by its earlier forecast of a price-drop of between -2 and -4% this year, but added some notable caveats. First, that “with mortgage rates continuing to ease, we may see an increase in confidence from buyers over the coming months,” and second, that “forecast uncertainty remains high given the current economic climate.”

Rightmove has not changed its forecast but in its December index, it wrote that “the average 5-year mortgage rate is now 4.86%, compared to 6.11% at the July 2023 peak. While there may be more surprises to come, early indicators suggest a more stable year for the mortgage market after its volatility from September 2022 onwards.” That perceived stability already seems to be driving greater activity this year, with Rightmove reporting a +5% increase in buyer demand compared to the first week of 2023.

The latest Residential Market Survey from RICS (published on 12 January) contained no specific price forecast but did report a positive trend in terms of sales activity. It said that its respondents “foresee a solid recovery in residential sales volumes emerging over the year ahead... At the same time, the average length of time to complete a sale continues to shorten.” It adds:

“Significantly, over the year ahead, respondents now foresee house prices stabilising at the national level… (but)feedback on house price expectations remains varied across different parts of the UK. Respondents based in Northern Ireland, the North West of England and Scotland anticipate prices moving higher on a twelve-month view.”

RENTAL DATA

Shown below are the average rates of annual rental growth according to the UK’s best-known rental indices.

Goodlord, December Rental Index + 7.1%

Homelet, December Rental Index + 8.0%

Home, January Asking Price Index +5.0%

Rightmove, Q4 Rental Price Tracker +9.2%

Zoopla, December Rental Market Report +9.7%

Rental growth figures published by ONS are usually lower than in other indices because they reflect the cost of new and existing tenancies. Even so, its latest data, published in January, showed that rents rose by +6.2% last year, the largest annual increase on record.

RENTAL SUPPLY & DEMAND

On 29th December, Propertymark published its Housing Insight Report for November. It stated that the number of tenants registered per member branch had held steady at 86, while the average number of lettable properties had fallen to just under 10. The organisation wrote that “on average, there were almost 9 new applicants registered per member branch for each available property.”

This was a little lower than Rightmove’s estimate, which suggested that estate agents are receiving an average of 11 tenant enquiries for every available rental property. This is nearly triple the ratio seen in 2019.

The supply of housing more generally continues to fall well short of demand. That’s according to a recently published report from Homes England. It noted that just 234,000 new homes were built in 2023, which is -6% less than in 2019-20 and significantly below the government's annual target of 300,000. In the same report, it quoted a Census forecast predicting that by 2045, the UK’s population would exceed 60 million.

In its latest survey, RICS noted that a net balance of +17% of survey participants reported rising tenant demand in December. It added that “with landlord instructions remaining scarce, having declined continuously over the past year, a lack of properties available on the lettings market continues to underpin rental prices.”

REGIONAL VARIATIONS IN RENTS

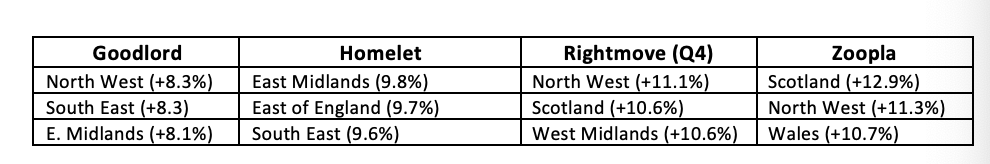

Different sources show different regional variations in annual rental growth. The following table lists the three best-performing regions by source. Figures in brackets refer to year-on-year growth rates.

The latest rental data from ONS showed that London “had the highest annual percentage change in private rental prices in the 12 months to December 2023 at +6.8%, while the North East saw the lowest at 4.6%.”

RENTAL YIELDS

The Q4 Rental Barometer from Fleet Mortgages noted that, on an annual basis, average yields have improved in all but three regions of England and Wales. The top regions for yields now include Wales (8.9%) the North West (8.6%), and Yorkshire & Humber (8.4%). Fleet found that Greater London produced the lowest yields at 5.5%, but even this figure was considerably higher than the current rate of CPI inflation (4.0%). The lender wrote that the average yield across England and Wales now stands at a respectable 6.9%.

Rightmove’s Rental Tracker for Q4 2023 reported average UK yields of 6.4%, which was a +0.5% improvement on last year. It stated that the strongest yields were to be found in the North East (8.7%), followed by Scotland (8.1%), Wales (7.7%) and the North West (7.2%). Like Fleet, it concluded that London produced the lowest yields, with a still respectable 5.4%.

PRIME CENTRAL LONDON

Rightmove’s January House Price Index included its usual feature on London boroughs. It noted that, on an annual basis, prices grew most strongly in Wandsworth (+5.8%) followed by Westminster (+2.9%), then Lambeth (+1.7%) Islington (+1.5%) and Hammersmith and Fulham (+1.4%). On a monthly basis, most London boroughs saw average values decline; most notably in Kensington and Chelsea, where they dipped by -4.9% over the course of December. Despite this late fall, the borough ended the year with values standing +0.6% higher than in December 2022.

Homelet’s December Rental Index includes a ‘London Focus’ section. It reports that average rents fell by -2.2% in London during the course of December, which it describes as “the greatest monthly fall since October 2020.” It takes the average to £2,127. That made the year-on-year growth figure +6.0%, “less than half the 14.6% growth seen in 2022.”

Nevertheless, some boroughs still produced very impressive returns. Lambeth saw the strongest growth in rents (+14.8% year-on-year), followed by Barking, Dagenham and Havering (+14.1%) and Westminster (+11.9%). The PCL boroughs of Hammersmith, Fulham, Kensington and Chelsea produced annual growth of just +3.5%. Homelet also shows 5-year rental growth and reports that Westminster remains the city’s front-runner, with +52.5%.

We’ll publish a more detailed analysis of the Prime Central London market in our Q1 Quarterly Market Report but below is a summary of key statistics published by LonRes.com.

PCL rental index (year-on-year change) +0.9%

PCL rental index (quartely change) +1.3%

Index for Prime London Fringe (y-o-y) +4.4.%

Yields (average for PCL) 3.71%

Yields (Prime London Fringe) 4.9%

Strongest PCL yields (Chelsea) 3.93%

INFLATION & THE BASE RATE

At the start of January, ahead of any announcements by ONS or the Bank of England, several lenders continued to cut the rates on their fixed-term products. So much so that rates on many 5-year fixes dipped below the ‘magic’ 5% threshold that some commentators had said would mark a psychological turning point for the market. Those pundits now expect market activity to accelerate as buyer confidence returns.

Predicting the Bank of England’s decisions on the official lending rate is never easy but at the start of the month, Goldman Sachs suggested that the Monetary Policy Committee could begin to reduce it as early as May of this year. This was followed by forecasts from Oxford Economics, Deutsche Bank and Investec, all of which have suggested that inflation could fall below the BoE target of 2% within the next four months.

The Guardian was one of several newspapers to report on the revised forecasts. It wrote that:

“Independent forecasters said a fresh review next month by officials at the Bank’s headquarters on Threadneedle Street was likely to follow their lead and predict a much lower path for inflation this year… (and) financial markets have brought forward betting on the first likely interest rate cut to April and raised the likelihood of another five cuts before the end of the year, bringing interest rates below 4% for the first time since January 2023.”

Oxford Economics noted that inflation was “on track to return to the 2% target in April.” Phil Shaw, senior UK economist at Investec, said that inflation would fall to 1.5% in the third quarter of the year and predicted that the Bank of England would start to cut rates in June. Deutsche Bank predicted that UK inflation could drop “a little below 2% in April and May”, but could edge up again due to disruption in global supply chains, particularly if that coincided with strong wage-growth and pre-election tax cuts.

However, for all the upbeat forecasts, inflation has proven to be stubborn. On Wednesday 17th January, ONS announcedthat CPI inflation rose fractionally over the course of December, from 3.9% to 4.0%. The principal drivers of the surprise increase, it said, were the rising cost of alcohol and tobacco products, which have become more expensive following a rise in tax duty. However, with transport costs and domestic bills falling, and with many other household costs rising by only 2.5%, the UK is expected to see inflation slowing in 2024.

The official Bank Rate currently stands at 5.25%, but the Monetary Policy Committee will meet again at the start of February to determine whether that rate will change.

SUMMARY

Affordability pressures are easing but they continue to dampen market activity, buyer sentiment and, of course, price growth. Lenders continue to reduce their rates, but for new buyers and borrowers who must remortgage this year, 2024 will still bring an unwelcome increase in mortgage costs. Consequently, the market is only likely to see modest growth in the coming months.

Nevertheless, there are grounds for optimism.

Market sentiment is improving, and market activity is increasing sharply.

CPI inflation has not changed radically this month but the general expectation is of a slow downward trend.

ONS reports that average earnings are rising by +6.6% year-on-year.

All UK regions are delivering real-terms rental growth.

Some UK regions are still delivering respectable capital growth.

In the UK’s more affordable markets, yields are significantly exceeding CPI inflation.

If you have any questions about any aspect of property investment, please call us today.